Alternative Benefit Funding

The Free Enterprise Solution to Health Care Reform

Alternative Benefit Funding is a new approach to group health insurance that allows mid-sized employers to take advantage of the same economic benefits that large, self-funded employers have utilized for years.

Improving Health – Controlling Costs

Alternative Benefit Funding is a self-funded approach with stop-loss insurance at relatively low attachment points to protect smaller employers from significant risk and exposure to large claims. Alternative Benefit Funding focuses on two overriding principles:

- Reduce the severity (cost) of claims your company will have.

- Reduce the frequency (number) of claims your company has overall.

By strictly adhering to these two overriding principles, Alternative Benefit Funding will help your company to proactively manage your health care program, not reactively adjust to it. Alternative Benefit Funding focuses on a “Pro-Active” approach with the goal of helping people before they become a claim-rather than waiting until they require medical intervention.

In contrast to a traditional program that focuses on managing a specific disease or condition, alternative benefit funding focuses our plan on the “Whole-Person” model to minimize claims that do happen and eliminate claims that shouldn’t happen.

The ultimate goal of alternative benefit funding is to reach “at risk” employees before they become a “claim” to the health plan.

Alternative Benefit Funding is the solution to meet the demands of many Health Care Reform requirements the PPACA mandated.

What is Alternative Benefit Funding?

Lowered Cost

Company receives a return of premium based on the group’s annual claims.

More Flexibility

Employer designs their own health plans including customized deductible, co-pays, and Rx.

Greater Transparency

Ability to see where your claim dollars are being spent in order to implement targeted cost reduction initiatives.

Cost Reduction Initiatives

Unique cost reduction solutions and wellness initiatives available to reduce overall claims.

Greater Control

Overall cost of health insurance is based on your group’s experience, not the insurance carrier.

Unmatched Service

Members receive access to Health Advocate which helps individuals navigate the health care system on a personal level.

Alternative Benefit Funding is a self-funded approach with stop loss insurance at relatively low attachment points to protect smaller employers from significant risk and exposure to large claims. Alternative Benefit Funding focuses on two overriding principles:

- Reduce the severity (cost) of claims your company will have.

- Reduce the frequency (number) of claims your company has overall.

By strictly adhering to these two overriding principles, Alternative Benefit Funding will help your company to proactively manage your health care program, not reactively adjust to it. Alternative Benefit Funding focuses on a “Pro-Active” approach with the goal of helping people before they become a claim-rather than waiting until they require medical intervention.

In contrast to a traditional program that focuses on managing a specific disease or condition, alternative benefit funding focuses our plan on the “Whole-Person” model to minimize claims that do happen and eliminate claims that shouldn’t happen.

Principles

Improving Health – Controlling Costs

Alternative Benefit Funding is a self-funded approach with stop loss insurance at relatively low attachment points to protect smaller employers from significant risk and exposure to large claims. Alternative Benefit Funding focuses on two overriding principles:

- Reduce the severity (cost) of claims your company will have.

- Reduce the frequency (number) of claims your company has overall.

By strictly adhering to these two overriding principles, Alternative Benefit Funding will help your company to proactively manage your health care program, not reactively adjust to it. Alternative Benefit Funding focuses on a “Pro-Active” approach with the goal of helping people before they become a claim-rather than waiting until they require medical intervention.

In contrast to a traditional program that focuses on managing a specific disease or condition, alternative benefit funding focuses our plan on the “Whole-Person” model to minimize claims that do happen and eliminate claims that shouldn’t happen.

The ultimate goal of alternative benefit funding is to reach “at risk” employees before they become a “claim” to the health plan.

How It Works

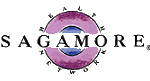

Alternative Benefit Funding is a form of self-funding that functions very similarly to an insured policy where the employer pays a set monthly amount based on the claim level they have chosen to fund to. But unlike an insured policy, the employer shares in a portion of the unused claims funds, after claim payments and plan costs. This approach allows even small employers to establish a monthly health plan budget and take advantage of the economic benefits of self-funding that many large employers have enjoyed for years.

- Employer pays a set amount each month during the twelve-month plan year to fund the plan. The monthly payment is determined for each employer based on a thorough underwriting review and the claim funding level.

- Employers can directly benefit from innovative plan design measures (reduced employer and employee costs), that large, self-funded employers currently utilize.

- Unlike insurance, if claims do not exceed the amount funded by the employer, a portion of the unused claim funds are shared with the employer.

Plan Management

All aspects of plan operation from administration to cutting edge plan designs are managed for you. Today, however, with the ever-rising health care costs, this isn’t enough. Our program goes much further because we partner with our clients to be proactive in identifying potential future claims and we design plans to maximize the latest, most sophisticated claim management system available.

- Early Indicators Forecasting: Revolutionary predictive modeling technology accurately categorizes plan members into various probability groups, thus, identifying and stratifying the likelihood of required surgeries. These identified groups are then addressed with specific action steps for each probability tier; both the health plan and its members benefit tremendously from this early identification and intervention. By utilizing this technology, we are able to “proactively” work with plan members to manage when and where a surgery should be. We provide plan members with the most qualified options to provide the highest quality, savings and satisfaction.

- Surgery Benefit Program: Your members have access to the best surgeons and Centers of Excellence in the country. It is a turnkey program where all aspects of a member’s surgery, from explaining, assisting with assembling medical records, making travel arrangements (if needed), to taking care of all registration and billings issues, is handled by our patient care coordinators so the member can focus on his/her surgery and recovery. The result is ‘best in class’ availability to the member to allow predictability and control over major, non-acute surgeries and dramatic savings for the plan and the member.

- State of the Art Wellness Programs: We offer personalized, state of the art, wellness programs as part of every plan. Through health risk assessments, disease management programs, online wellness coaching and information, and personalized one-on-one, custom-designed wellness coaching, we are able to drive down the demand for services along with the cost of services to significantly reduce the cost of health care services.

- Health Advocate: As part of your health care plan, we provide your members with an advocate that is available 24/7/365 to assist them with any questions, concerns, problems, or advice they may be looking for assistance with. This includes plan design questions, second opinions, assistance with scheduling appointments with providers, advice on “best in class” providers, advice on alternatives available for any particular illness or condition, information on all available plan benefits, assistance on negotiating claim payments, providing area-specific pricing for a multitude of procedures, helping members negotiate the best price for a procedure “up front” and helping members navigate through all of Medicare’s options and procedures. This service is available to all adult plan members, their parents, and parents-in-law.

- At a minimum, quarterly, we will review your programs performance to verify the plan design is maximizing our claim management tools and working to reduce your plan costs. We will make specific plan recommendations based on the plan performance to further control current costs and eliminate future costs. Health care in the 21st century is not about being reactive but about proactively managing your plan through innovative plan design, employee education and involvement and a healthy workforce.

Why Self-Insure

When employers choose to self-insure, they have the ability for greater flexibility and cost savings. They now control a larger part of the dollars spent on health care because they pay the majority of their claims directly. As a result, if the employees are wise consumers of health care, the employer will have reduced costs over a fully insured plan.

Traditional Health Plan vs Alternative Benefit Plan

FAQs

Does the Alternative Benefit Funding program include insurance protection?

Yes. While the program is self-funded, stop-loss insurance protection is triggered at relatively low attachment points. This is to provide small employers with the ability to self-fund but also better control their risk and exposure to significant claims. Once the attachment points are met, insurance protection is provided through the stop-loss carrier.

Who is the stop-loss carrier for the Alternative Benefit Funding program?

Guarantee Trust Life Insurance Company is the stop-loss carrier. (www.gtlic.com) They have specialized in employee benefits for more than 90 years with an A.M. Best rating of A- (Excellent). They currently market insurance products in 49 states and the District of Columbia.

Who handles the claims for Guarantee Trust Life Insurance Company in the U.S.?

All claims are handled by Regency Employee Benefits (REB), a Third Party Administrator (TPA) of health care claims. REB is located in Port Huron, Michigan and has been a TPA since 1978 and paying claims since 1970.

How do I know that Guarantee Trust Life Insurance Company is financially stable and will be there when I have a claim?

They have specialized in employee benefits for more than 90 years with an A.M. Best rating of A- (Excellent). They currently market insurance products in 49 states and the District of Columbia.

What safeguards are in place for large catastrophic claims?

Guarantee Trust Life Insurance Company stop loss policy provides unlimited coverage limits for all covered claims as required by the Federal Health Care Reform Law PPACA.

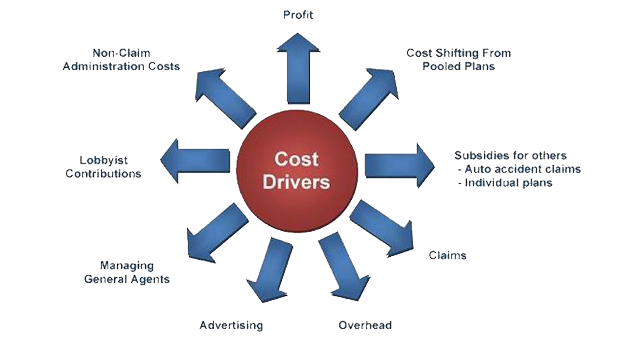

Cost Drivers

Robbins Group Offers Personal Insurance

Robbins Group offers personal insurance that covers home, auto, renters, umbrella, and boat. Visit our insurance coverage page to see our offerings.

More About Robbins Group